1

/

of

11

www.ChineseStandard.us -- Field Test Asia Pte. Ltd.

GB/T 31277-2022 English PDF (GB/T31277-2022)

GB/T 31277-2022 English PDF (GB/T31277-2022)

Regular price

$290.00

Regular price

Sale price

$290.00

Unit price

/

per

Shipping calculated at checkout.

Couldn't load pickup availability

GB/T 31277-2022: Brand valuation - Retail industry

Delivery: 9 seconds. Download (and Email) true-PDF + Invoice.Get Quotation: Click GB/T 31277-2022 (Self-service in 1-minute)

Newer / historical versions: GB/T 31277-2022

Preview True-PDF

Scope

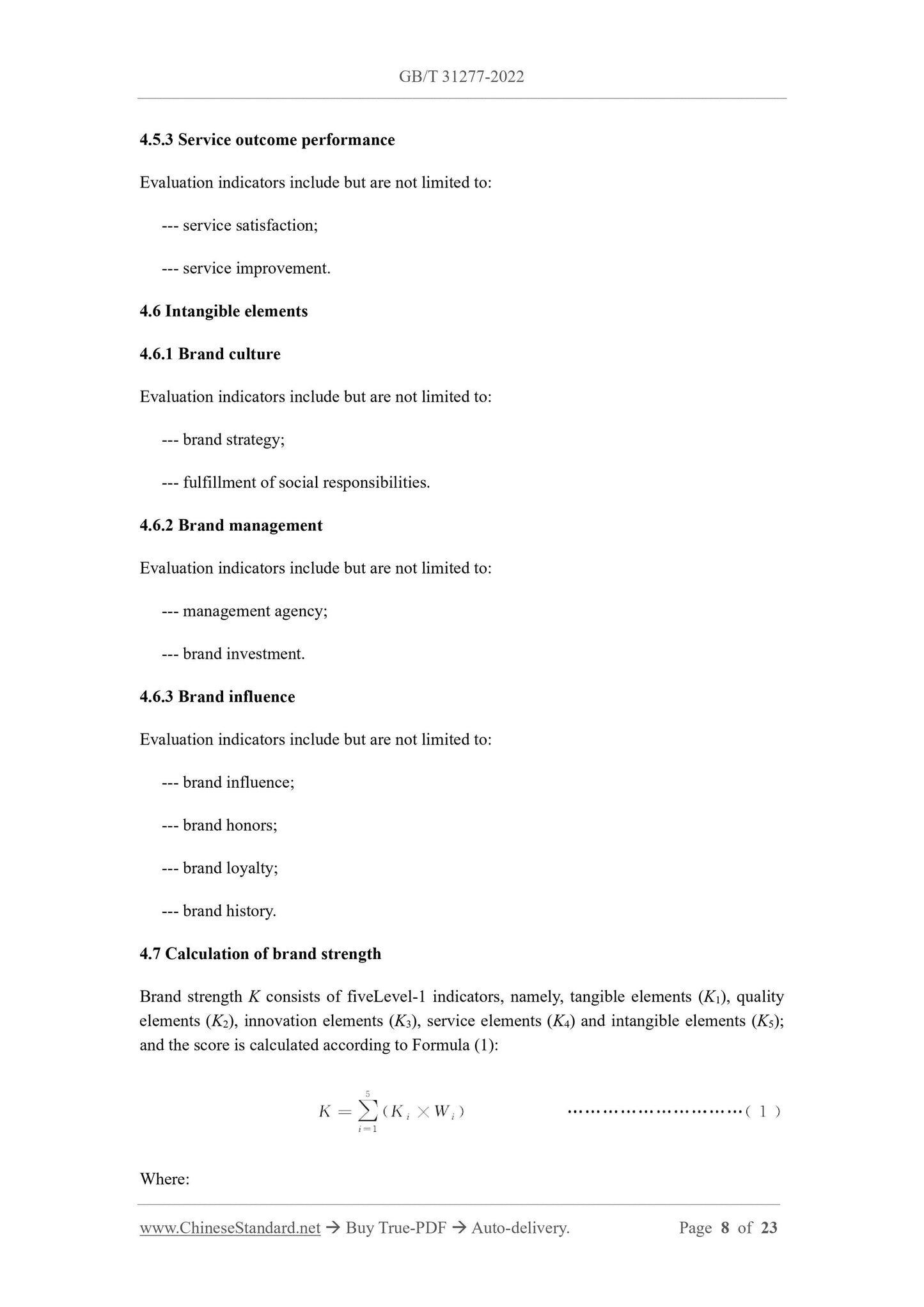

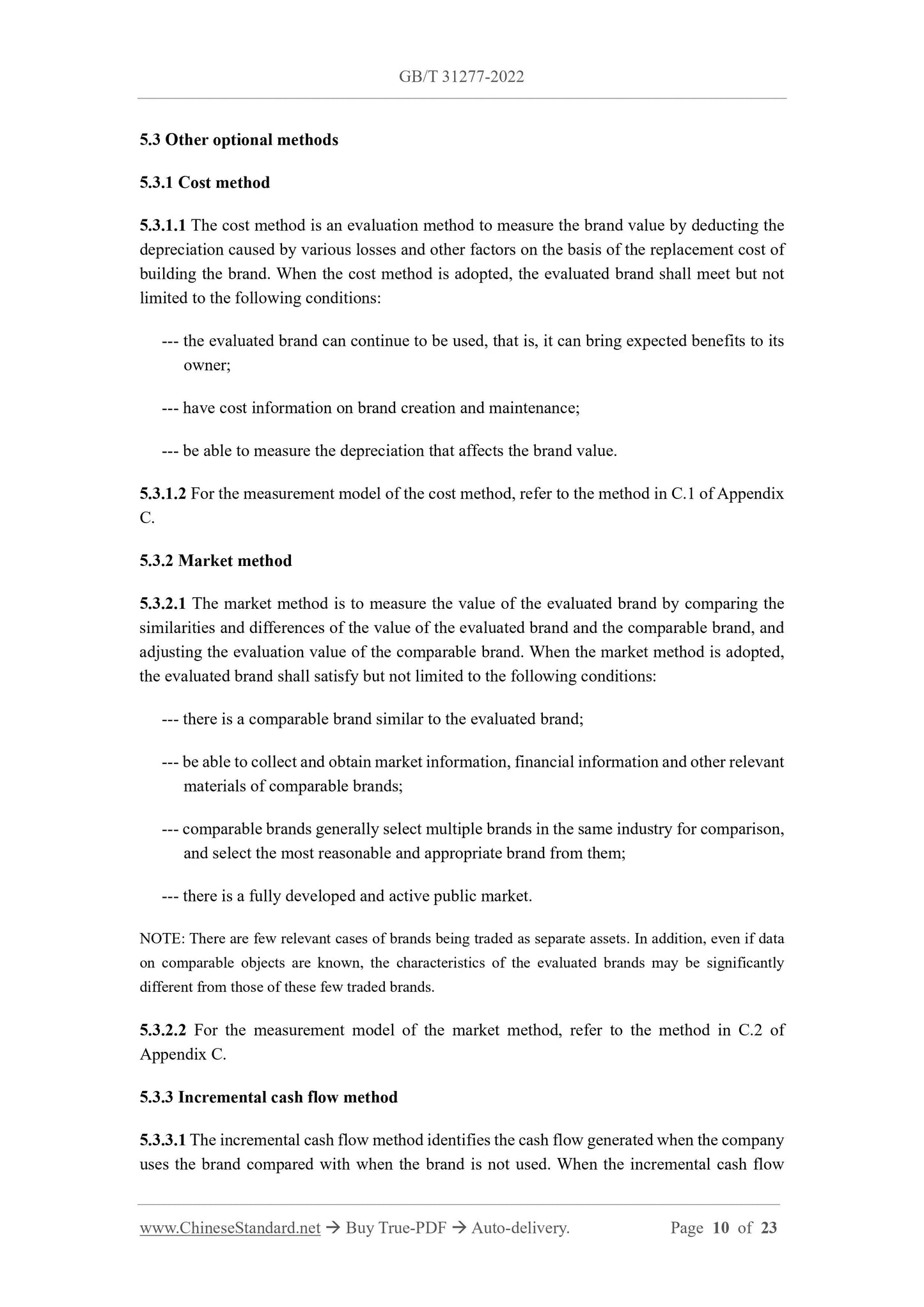

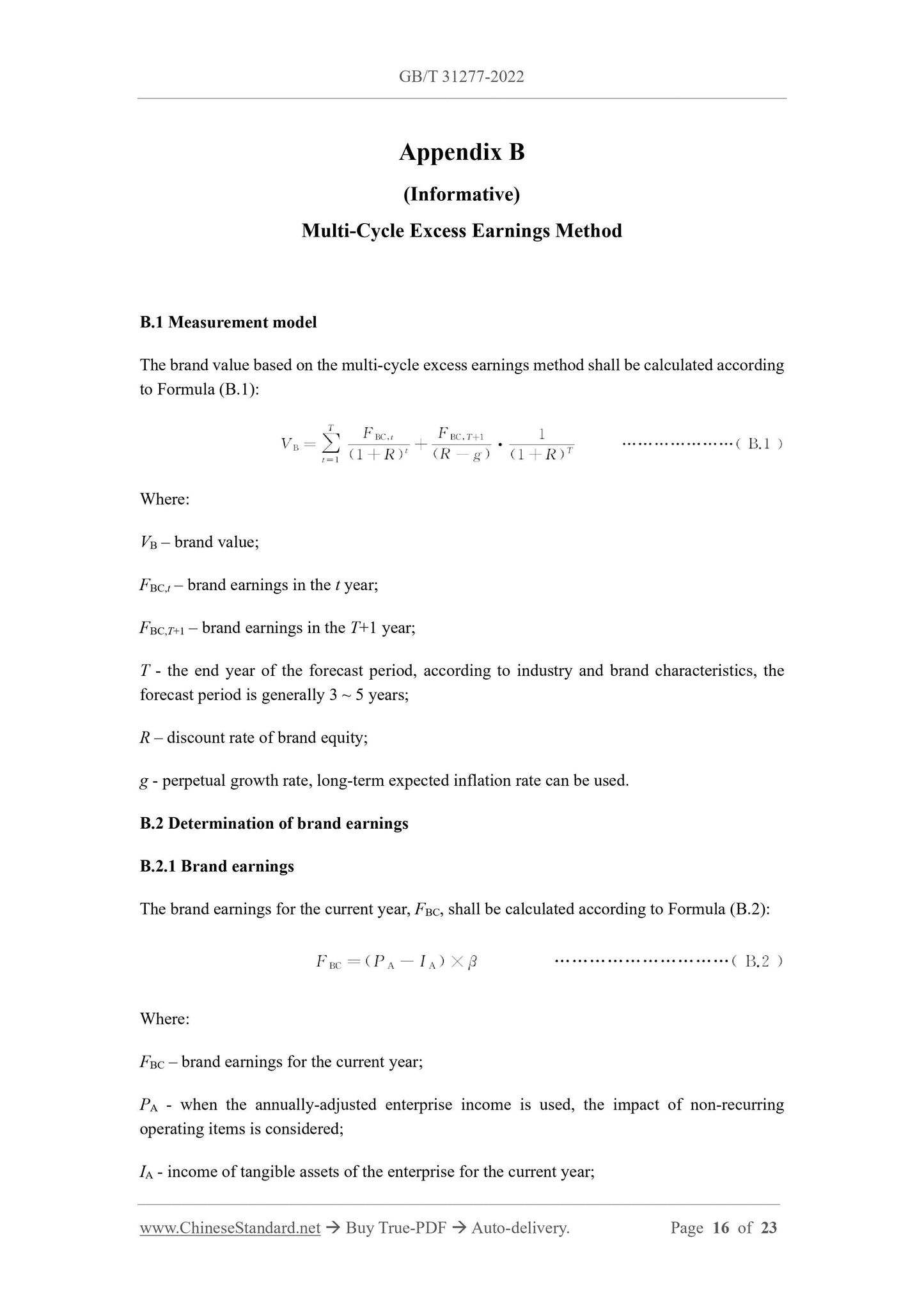

This Document specifies the brand strength, measurement model, and evaluation process forbrand valuation in the retail industry.

This Document is suitable for brand valuation of retail enterprises, and can be used for self-

evaluation or third-party evaluation.

Basic Data

| Standard ID | GB/T 31277-2022 (GB/T31277-2022) |

| Description (Translated English) | Brand valuation - Retail industry |

| Sector / Industry | National Standard (Recommended) |

| Classification of Chinese Standard | A00 |

| Word Count Estimation | 17,129 |

| Issuing agency(ies) | State Administration for Market Regulation, China National Standardization Administration |

Share