1

/

of

12

www.ChineseStandard.us -- Field Test Asia Pte. Ltd.

GB/T 19584-2010 English PDF (GB/T19584-2010)

GB/T 19584-2010 English PDF (GB/T19584-2010)

Regular price

$150.00

Regular price

Sale price

$150.00

Unit price

/

per

Shipping calculated at checkout.

Couldn't load pickup availability

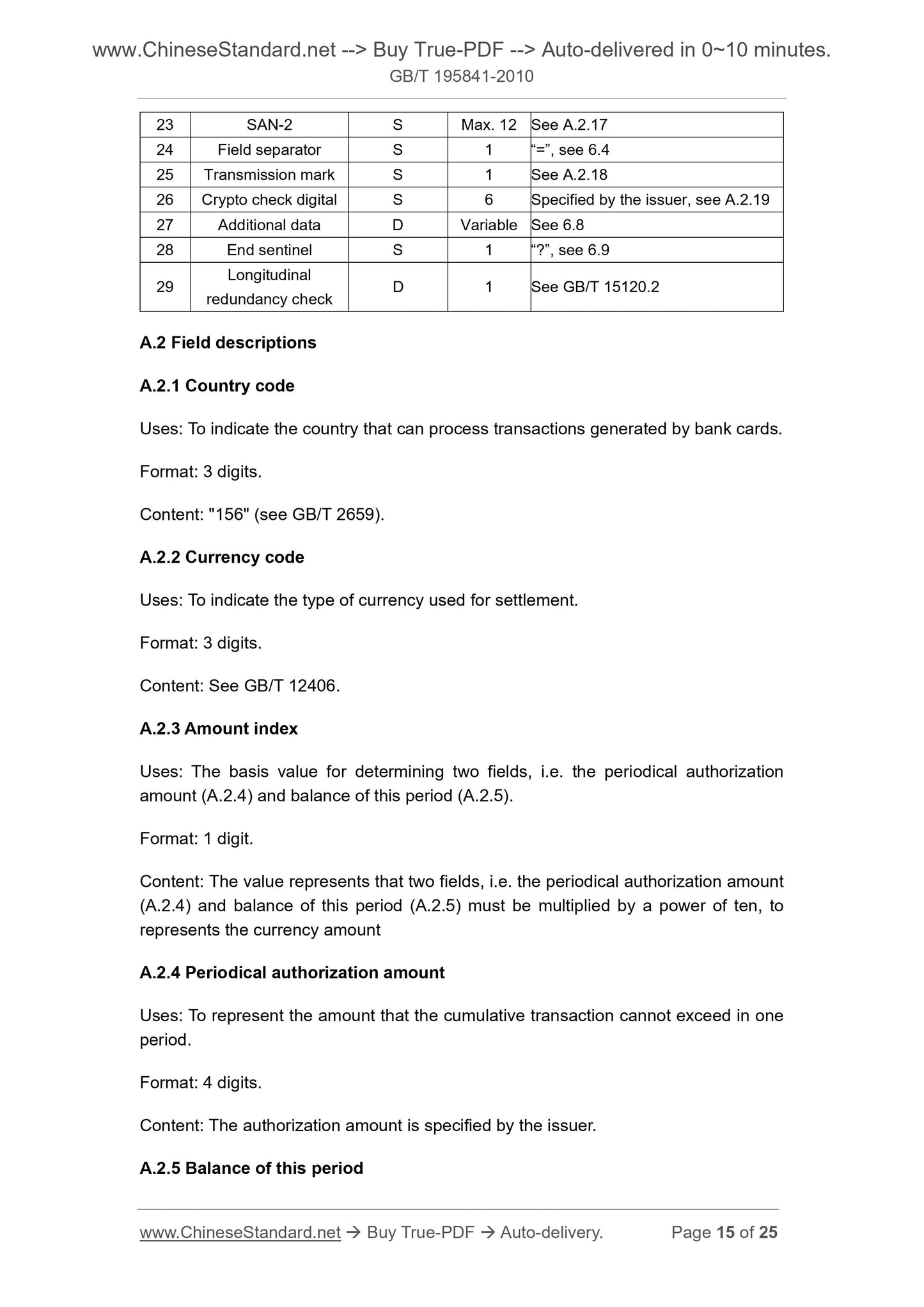

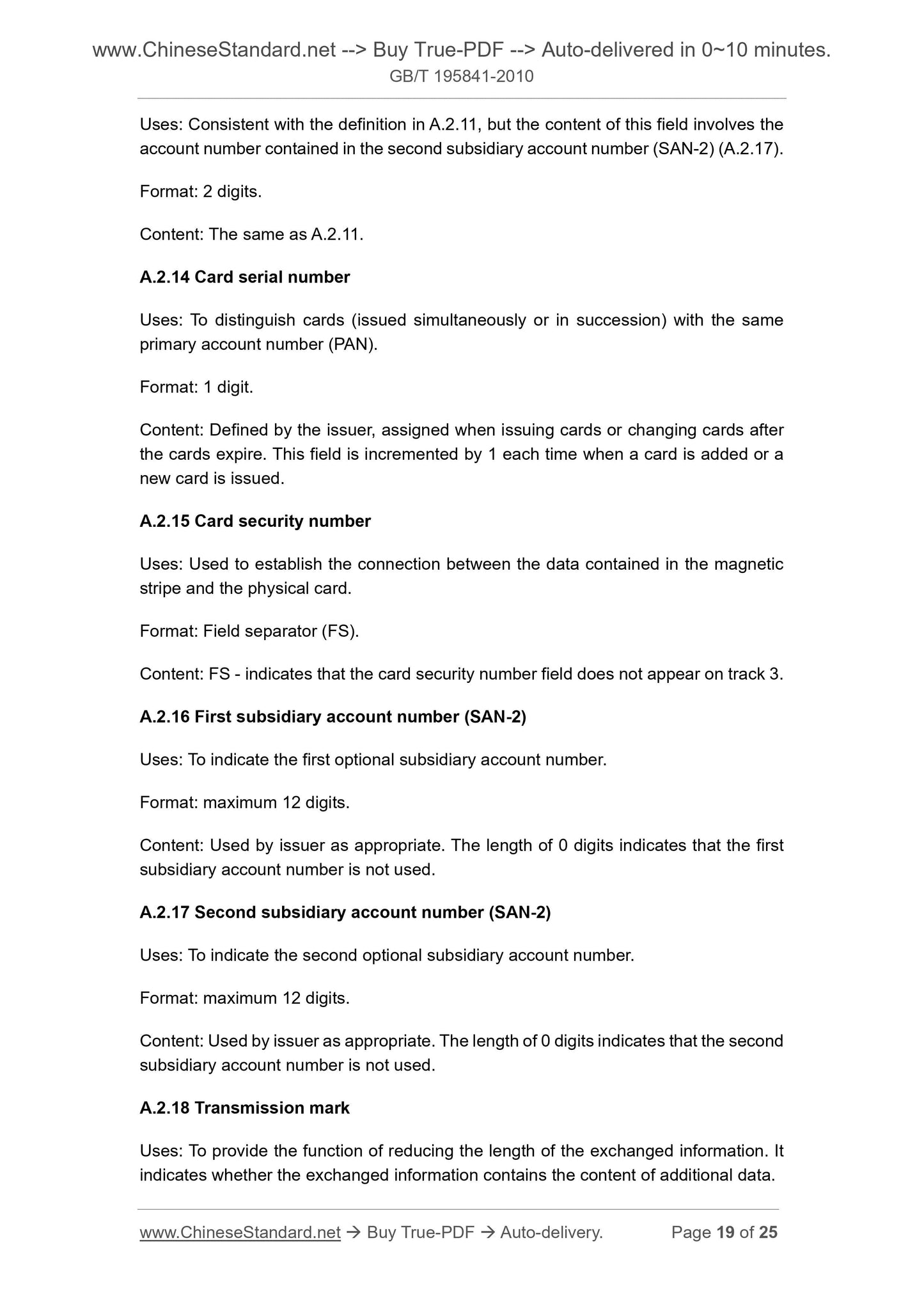

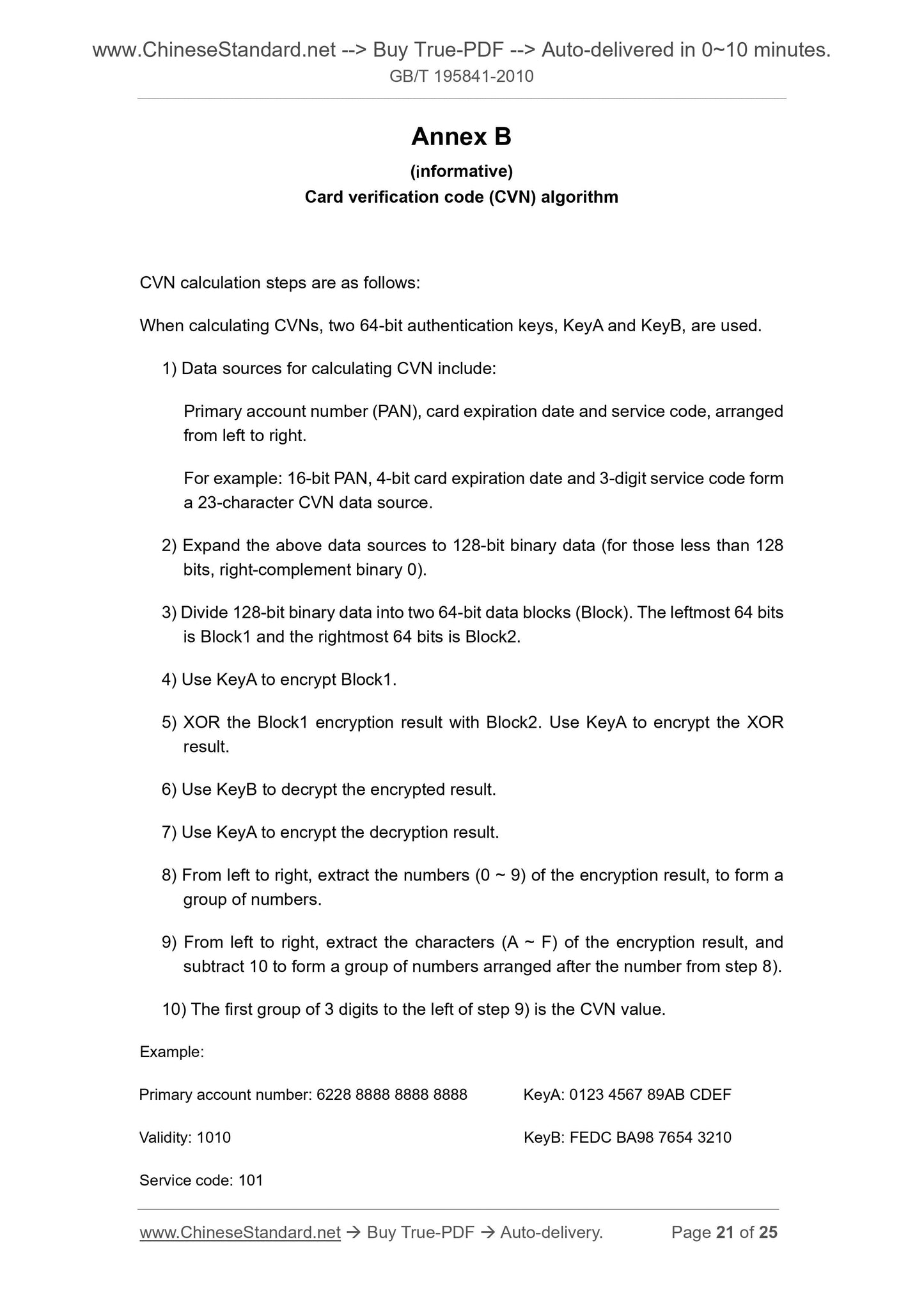

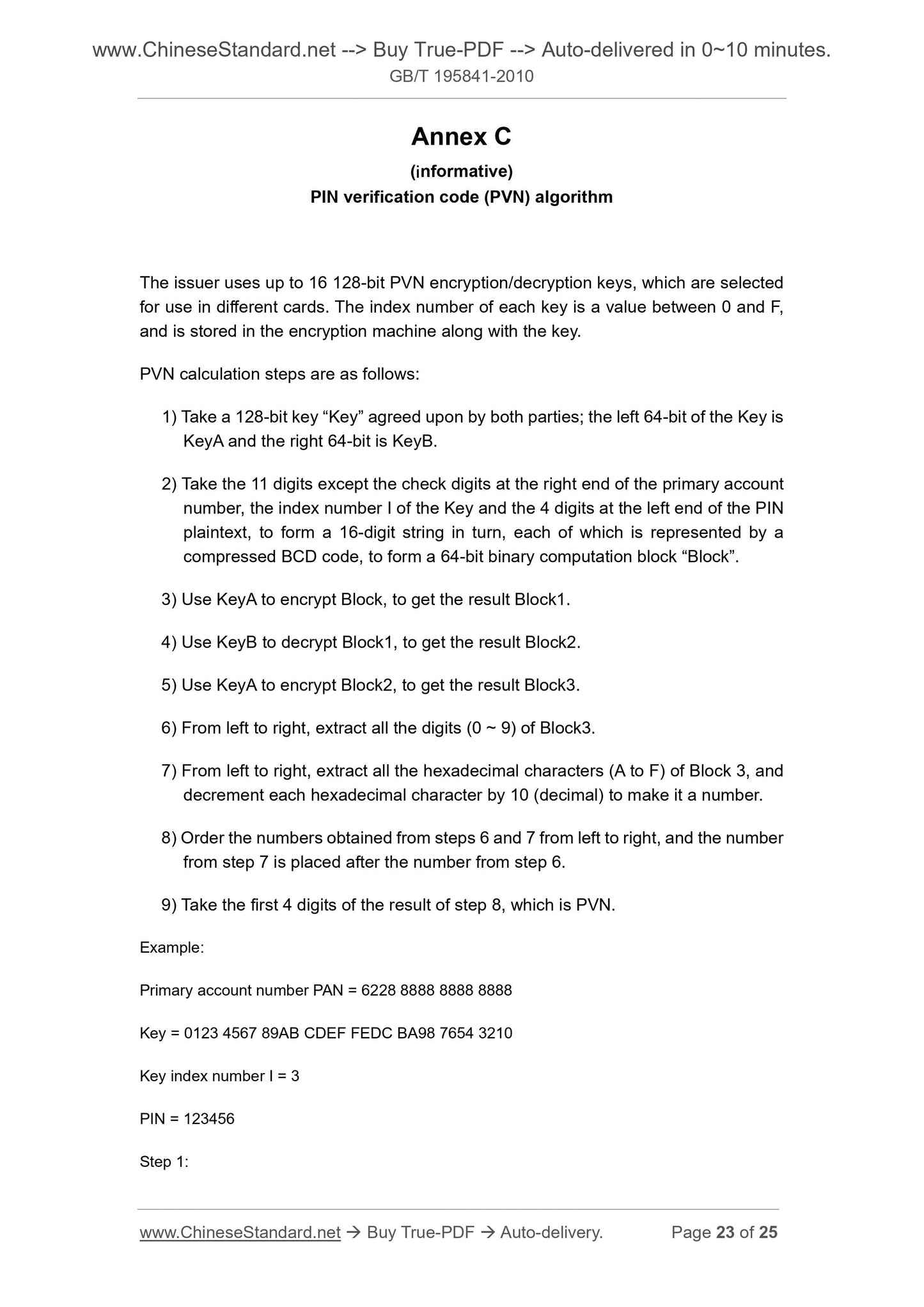

GB/T 19584-2010: Specification on magnetic stripe data content and application for bank card

Delivery: 9 seconds. Download (and Email) true-PDF + Invoice.Get Quotation: Click GB/T 19584-2010 (Self-service in 1-minute)

Newer / historical versions: GB/T 19584-2010

Preview True-PDF

Scope

This Standard specifies the specification on magnetic stripe data content andapplication for bank card.

This Standard applies to all kinds of bank cards issued and used in the People’s

Republic of China.

Basic Data

| Standard ID | GB/T 19584-2010 (GB/T19584-2010) |

| Description (Translated English) | Specification on magnetic stripe data content and application for bank card |

| Sector / Industry | National Standard (Recommended) |

| Classification of Chinese Standard | A11 |

| Classification of International Standard | 35.240.15 |

| Word Count Estimation | 18,176 |

| Date of Issue | 2011-01-14 |

| Date of Implementation | 2011-05-01 |

| Older Standard (superseded by this standard) | GB/T 19584-2004 |

| Quoted Standard | GB/T 2659; GB/T 12406; GB/T 15120.2; JR/T 0008 |

| Regulation (derived from) | National Standard Approval Announcement 2011 No.2 |

| Issuing agency(ies) | General Administration of Quality Supervision, Inspection and Quarantine of the People's Republic of China, Standardization Administration of the People's Republic of China |

| Summary | This standard specifies the magnetic stripe bank cards and use standardized message formats. This standard applies to the issue of the PRC and various bank cards. |

Share